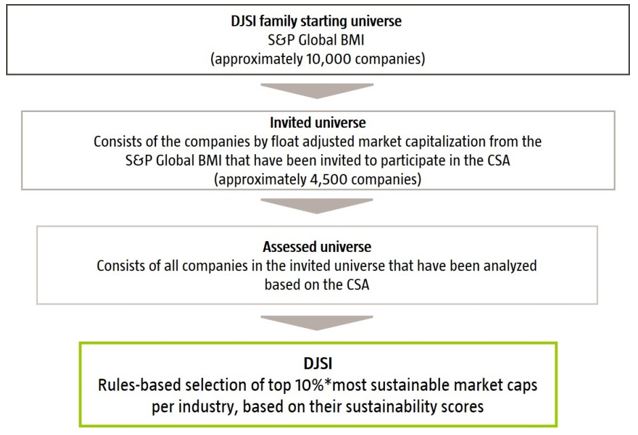

The Dow Jones Sustainability Indices (DJSI) are a family of best-in-class benchmarks for investors who have recognized that sustainable business practices are critical to generating long-term shareholder value and who wish to reflect their sustainability convictions in their investment portfolios. The family was launched in 1999 as the first global sustainability benchmark and tracks the stock performance of the world’s leading companies in terms of economic, environmental and social criteria. Created jointly by S&P Dow Jones Indices and Robeco Sustainable Asset Management (SAM), the DJSI combine the experience of an established index provider with the expertise of a specialist in Sustainable Investing to select the most sustainable companies from across 61 industries. The DJSI World applies a transparent, rules-based component selection process based on the companies’ Total Sustainability Scores resulting from the annual S&P Global Corporate Sustainability Assessment (CSA). Only the top ranked companies within each industry are selected for inclusion in the Dow Jones Sustainability Index family. No industries are excluded from this process as shown in Figure 1.

* Global Indices: Top 10%, Regional Indices: Top 20%, Country Indices: Top 30%

Figure 1

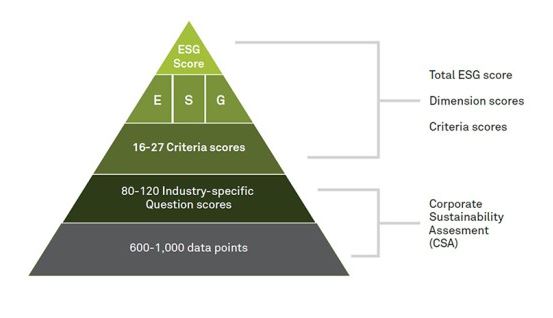

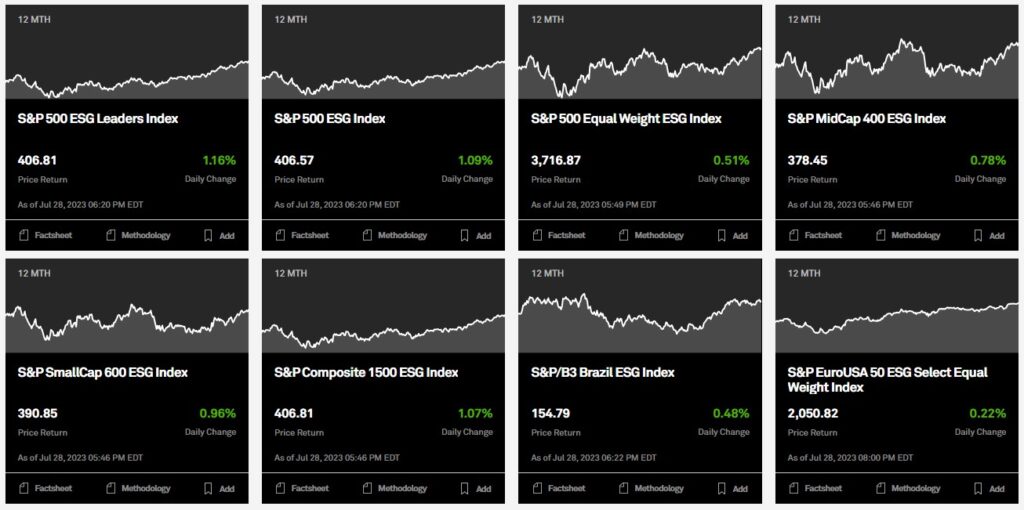

The composition of the DJSI is reviewed each year in September based on the S&P Global ESG Scores resulting from the annual SAM and CSA and is rebalanced quarterly (S&P Global, 1, 2023). The CSA has become the basis for numerous ESG indices over the last two decades. S&P Global acquired the CSA in 2019, which included the transition of the related ESG ratings and ESG benchmarking teams and that now operate out of S&P Global Switzerland. The Corporate Sustainability Assessment (CSA) empowers you to leverage the unique expertise and the proprietary methodology and database underlying the world’s most renowned sustainability indices (S&P Global, 2, 2023). While increasing numbers of companies have chosen to participate in the CSA, annual reviews have enabled the questions to be refined and streamlined over the years. The result is that currently relevant sustainability themes are combined with the systematic introduction of emerging sustainability issues and it can be said that it is the continuing evolution process of the CSA (S&P Global, 3, 2023). Starting April 2019, S&P DJI has begun further leveraging SAM sustainability data to deliver an extensive range of ESG indices. The S&P ESG Index Family, which are sets of indices, offers investors exposure to companies according to their ESG profile in the context of country-specific and regional indices. The index families are based on S&P DJI ESG Scores, based on the results of the annual S&P Global Corporate Sustainability Assessment (CSA). The index family includes broad market indices like the S&P 500 ESG, S&P Europe 350 ESG, S&P Global 1200 ESG, and S&P Japan 500 ESG, designed to closely track their parent indices with similar risk and return profile and low tracking error. The key criteria for constituent eligibility and selection in the S&P ESG Index Family are the S&P DJI ESG Scores. The scores contain a total company-level ESG score for a financial year, comprising individual environmental (E), social (S), and economic & governance (G) dimension scores. The criteria scores are weighted to eliminate biases among different industries and companies that complete the CSA versus companies that are assessed on the basis of publicly available information. The methodology of the S&P ESG Index Family is constructed to be simple, with a selection process meant to keep index’s industry weights in line with S&P broad market indices. The index methodology results in improved composite ESG scores, and offers improved ESG performance across each industry group (S&P Global, 4, 2023). Figure 2 Shows the score of CSA and ESG Indices, and figure 3 shows an example feature of S&P ESG Indices (S&P Global, 5, 2023).

Figure 2

Figure 3

The Corporate Sustainability Assessment (CSA) will ask invited companies about methodologies and rationales of reporting in order to gather information from invited companies for calculating the S&P Global ESG Score, which is a crucial part of the Dow Jones Sustainability Indices (DJSI). CSA provides a guideline, called CSA Handbook, to be a check list for invited companies’ activities. For each covered question, this document provides the Assessment Focus, the Question Rationale, details of the Question Layout and specific guidance on how to answer. Moreover, the Question-Specific Guidance & Definitions sections define the terms that use and provide details on how to interpret and answer each question. They also specify the question’s alignment with the GRI or other standards and framework (Based on GRI mainly), and whether internal or public documents will be necessary to answer the question. The CSA is a holistic assessment, but the structure and weighting of each criterion depends on its financial materiality in a given industry. To aid companies’ preparation for the CSA, it shares the weights for the different aspects of the assessment under CSA Methodology. It also provides general guidance on how to complete the CSA, its expectations and some general tips for a successful submission. Each question in the questionnaire consists of one or more sub-questions. Invited companies are given the possibility of selecting one or more answers to each question. Each question also contains a standard set of answer options that enable you to indicate if a company do not have the information asked for or if the question is not applicable to that company. For the Assessment focus, there are icons to give an indication of what CSA looking for as showed in Figure 4 (S&P Global, 6, 2023).

Figure 4

Every year more companies see the value of disclosing their sustainability performance to capital markets via active participation in the Corporate Sustainability Assessment (CSA). In 2023, 13,800 companies were invited to complete the CSA. Of those, 3,519 companies were eligible for selection into a Dow Jones Sustainability Index (DJSI). A record number of 1,728 DJSI eligible companies actively participated, an increase of 9% over last year in this group. Of all invited companies, 2,480 have already submitted, representing over 48% of global market capitalization, relative to the S&P Global Broad Market Index (BMI), up from 45% in 2021. The assessment is still ongoing until end of January. Participating companies can choose the degree to which they permit S&P Global to share underlying datapoints submitted in the CSA that are supplemental to the company’s public reporting. The majority of participating companies took advantage of this option to leverage S&P Global’s platforms to communicate this information to a wider capital market audience. To inform the growing number of ESG-focused investors about corporate sustainability performance. Companies will be invited in 3 groups, starting with those eligible for any Dow Jones Sustainability Index (DJSI), then companies will be chosen from 3 factors including:

Companies that are invited but decide not to participate may be assessed by S&P Global based on publicly available information, and the resulting ESG Scores and data may be shared via S&P Global platforms. Participation in the CSA is not a prerequisite for eligibility in the DJSI or other S&P ESG Indices. Official invitations will be sent out between February and June. Companies may also check their invitation status via CSA online platform.

Any company interested in the CSA that agrees to make their resulting ESG Score public on S&P Global platforms will be assessed free of charge by contact [email protected] for more information. The 2023 CSA questionnaire opens for all companies on April 4th. New for this year, companies are able to select an assessment window that best meets individual reporting schedules. Log in to the CSA Portal to reserve a slot (S&P Global, 7, 2023).

In Thailand, there are currently 26 Thai companies in DJSI, which is the highest number in ASEAN, including ADVANC, AOT, BANPU, BDMS, BJC, BTS, CPALL, CPF, CPN, CRC, DELTA, EGCO, GPSC, HMPRO, IRPC, IVL, KBANK, MINT, PTT, PTTGC, SCB, SCC, SCGP, TOP, TRUE and TU. There are 11 Companies among These 26 companies, which has world class potential to be in DJSI World Family and achieve ESG Index Family (SET, 2022).

Recent Articles