Global Reporting Initiative (GRI) standards are strongly aligned with the UN Sustainable Development Goals and provide resources and tools that enables companies understand and communicate their contribution to the SDGs. Information from GRI reveals that 82% of 250 big companies in the world adopted GRI standards for reporting sustainability issues and 10,557 companies around the world are following the GRI standards with more than 27,000 published papers. There are 177 listed and non-listed companies in Thailand that used that GRI standards with 342 published papers. GRI is an independent entity that was established by United Nation Environment Programme (UNEP) with Ceres Company Network by launched the first standards in 2000, called G1. Then, the standards have been developed until G4 which totally different from G1 by emphasized on qualitative reporting rather than quantitative reporting, especially in terms of disclosure of analysis issues, material aspects and stakeholder analysis. Moreover, there also was change in the level of reporting from A, B, C, which cause confusion between grading quality and scale of disclosure following GRI guideline, to be “In accordance” in form of “Core” or “comprehensive” instead of the level. This change entailed organizations highlight more about contents that relevant to their business contexts and stakeholders. After the popular version (G4), GRI recently launched “GRI Standards” for replacing G4 in 2016 by maintaining principal and format of reporting, but the change was structure of reporting which is more systematic and less of redundancy of reporting data by changing some significant indicators. Furthermore, structure of the GRI standards was designed for internal changing of organization’s indicators and regulations in the future without reviewing entire report. GRI standards was not created for only communication, but also being checklist in order to help organizations plan their long-term strategy. Michael Meehan stated in “Sustainability Reporting as a Tool for Better Risk Management” from MIT Management Review 2016 that following GRI guideline will help organizations to see a gaps between business operation and stakeholder needs in value chain. Organizations will have “the development” for creating “value add” when they can close those gaps and reduce potential risk in the future. Therefore, GRI is business management rather than a reporting, which comprises of 3 foundations of reporting including in gathering data processes, codification processes and connecting data with organizational strategies, and operational metrics particularly. These processes spotlight on operational progress and priority, and also provide efficient data for decision makers in organizations in terms of adding value by sustainability such as adopting an innovation for improving competitive capability. The sustainability report can be in deferent formats according to organizational readiness. It can be either a part of annual report or separated report, or published in form of paper, digital file, or website, organizations should concern about users and appropriate channel though. In addition, there currently are many forms of presentation like infographic, motion clip or social media that organizations can adopt for making productive ESG report and good brand image simultaneously (Tantimangkorn, A. and Ekachaiphaiboon, S., 2017). The GRI Standards are the only global standards with an exclusive focus on impact reporting for a multi-stakeholder audience – making it an essential factor in the shaping of a reporting structure. For example, GRI has a key role in working with European Financial Reporting Advisory Group (EFRAG) and the International Sustainability Standard Board (ISSB) to build this comprehensive global set of sustainability reporting standards. Only then the two-pillar structure can be created – for financial and sustainability standards – with a core set of common disclosures and each pillar of equal footing. Covering the information needs of investors as well as other stakeholders, this will increase confidence and credibility in the sustainability behavior of companies. GRI has a robust policy in cooperate with EFRAG, the ISSB, and (inter) governmental organizations to drive sustainability disclosure in a two-pillar reporting structure. Credibility is created through accountability. And accountability can only be provided through transparency. Frameworks without a definite reporting obligation cannot fulfil this purpose – but publishing relevant information based on widely used truly global corporate reporting standards – underpinning both the financial and impact materiality perspective of sustainability (GRI, 4., 2022).

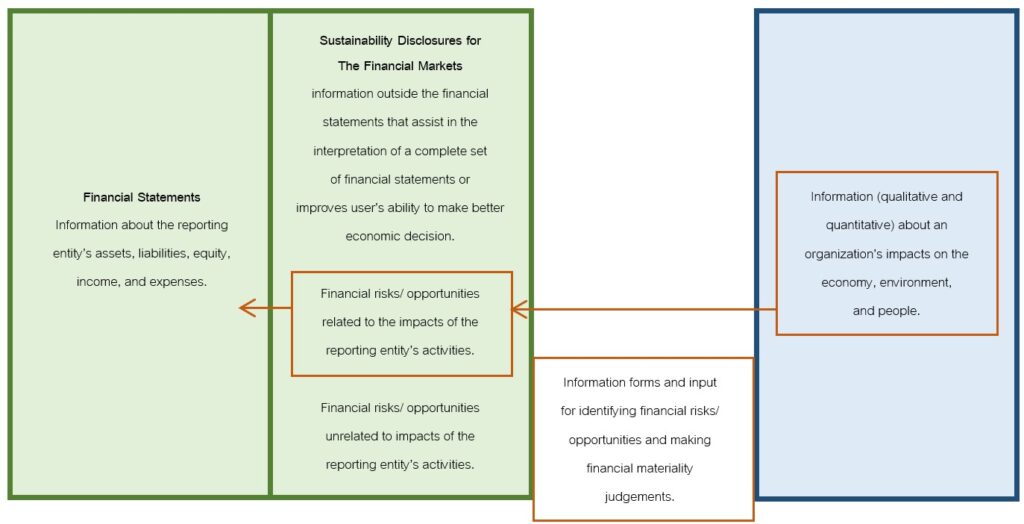

The sustainability reporting landscape is changing fast. With the rise of dedicated Environmental Social and Governance (ESG) investments, rankings and exchange-traded funds, the need for standardized, comparable information to enhance decision making by shareholders and stakeholders. On the other hand, cherry picking, and greenwashing are bigger than ever for avoiding standard and framework shopping. The current landscape is often referred to as an ‘alphabet soup’. While there is a confusing myriad of guidelines, frameworks, surveys, and certifications that deal with the topic of sustainability, there is no a confusing assortment when it comes to actual standard setters. On a global scale there are only two reporting standards: GRI and SASB. There are currently two complementary developments happening in the sustainability reporting landscape: 1) European Sustainability Reporting Standards (ESRS) are being created by the European Union– with EFRAG and GRI leading co-construction efforts. 2) Standards for the disclosure of sustainability-related financial information are being drafted by the International Financial Reporting Standards (IFRS) Foundation – with which the newly established International Sustainability Standards Board (ISSB) is charged. The main differences between them are: 1) First, the European Union is focused on developing reporting standards that reflect multi-stakeholder information needs on the full sustainability spectrum across socio-economic and environmental aspects. The exclusive remit of the standards developed by the IFRS Foundation is on the needs of investors and the financial impact of sustainability issues on the reporting entity itself, focusing on enterprise value creation. 2) The second major difference is enforcement. The EU standards are backed by a political process and enforcement capabilities, making reporting mandatory for some 50,000 companies from financial year 2023. IFRS can only encourage uptake of ISSB standards. Towards a two-pillar corporate reporting landscape GRI firmly supports the creation of a comprehensive corporate reporting system based on a two-pillar structure – for financial and sustainability reporting – with a core set of common disclosures and each pillar on an equal footing based on the idea that sustainability reporting initiatives should not be regarded as competing but complementary forces as shown in Figure 1.

• Pillar 1 – addressing financial considerations through a strengthened financial report which includes sustainability disclosures, in the context of enterprise value.

• Pillar 2 – concentrating on sustainability reporting exposing on all external impacts a company is having on society and the environment and hence their contributions towards the goal of sustainable development.

Figure 1 (GRI, 3., 2022, 2)

GRI is fully committed to supporting this sustainability objective and will cooperate with the ISSB, EFRAG and (inter) governmental organizations to drive sustainability disclosure in a two-pillar reporting landscape forward and call for:

In 2021, GRI responded on the updated strategic direction of the IFRS Foundation and the establishment of a working group between GRI and IFRS. In November 2021, GRI welcomed the announcement of the launch of the ISSB, which included the consolidation of the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VRF) (which includes the IIRC and SASB) into the ISSB. GRI has previously had long-running collaborations with both the IIRC and SASB, including a 2021 joint report on how to use GRI and SASB standards together. In March 2022, GRI and the IFRS Foundation signed a Memorandum of Understanding (MoU) to coordinate their work programs and standard-setting activities as well as join each other’s consultative bodies related to sustainability reporting. By working together, the IFRS Foundation and GRI provide two pillars of international sustainability reporting – a first pillar representing investor-focused capital market standards of IFRS Sustainability Disclosure Standards developed by the International Sustainability Standards Board (ISSB), and a second pillar of GRI sustainability reporting requirements set by the Global Standards Setting Board (GSSB), compatible with the first and designed to meet multi-stakeholder needs. On the other hand, Since July 2021, GRI and the European Reporting Advisory Group (EFRAG) have been working together to co-construct the European Sustainability Reporting Standards (ESRS), which will set mandatory disclosure requirements under the EU Corporate Sustainability Reporting Directive (CSRD). Under the EFRAG-GRI cooperation agreement, the two organizations agreed to join each other’s technical expert groups and align standard-setting activities and timelines as much as possible (GRI, 2., 2023).

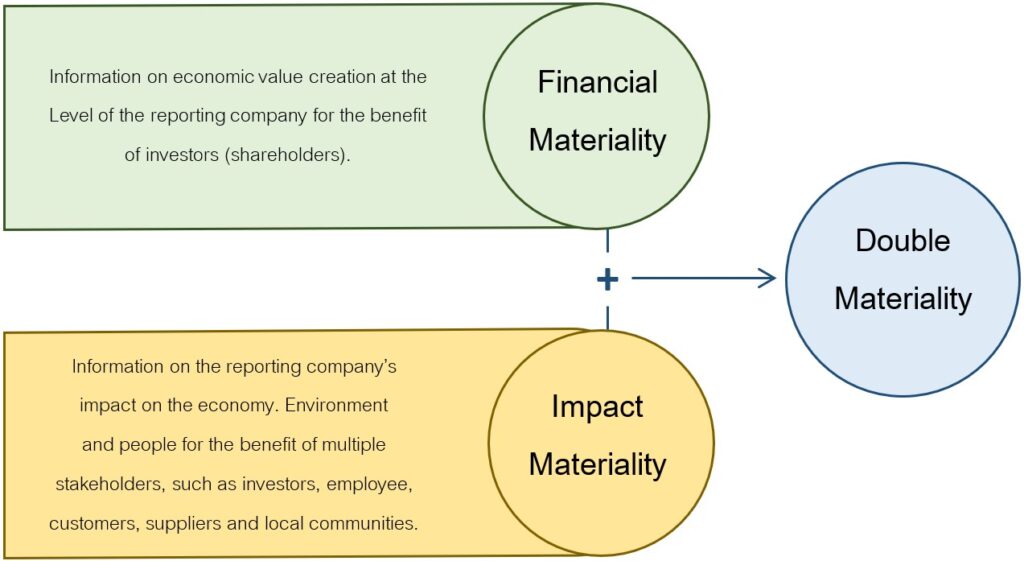

Back to basics, Materiality is a key concept in the world of reporting and plays a part both in the preparation of the disclosures and their verification by an auditor. Materiality is used to ‘filter in’ the information that is or should be relevant to users. Particular information is considered ‘material’ – or relevant – if it could influence the decision-making of stakeholders in respect of the reporting company. This brief description outlines that materiality is not a clear-cut concept and is subject to interpretation. What matters is not just what is meant by information but, crucially, who the stakeholders are. Are these only financial decision-makers such as investors and financiers? Or do they also include other parties such as employees, suppliers, customers and communities; that is, the socioeconomic environment? The next question is how influence must be interpreted for an organization’s stakeholders. Is this purely financial, in terms of costs or compliance – in other words, value creation for the reporting company itself? Or must it be viewed in terms of impact on the economy, the environment and people? There are the confusions around the concept of materiality for defining significant. To make it clear from the start, GRI determine two main directions of thinking about materiality, which together make up the concept of ‘double materiality’ as shown in Figure 2:

Figure 2 (GRI, 1., 2022, 2)

Recently There are wildly used terms in addition to the more familiar concepts of financial materiality and impact materiality such as: ‘dynamic materiality’, ‘nested materiality’, ‘extended materiality’ and ‘core materiality’. They are meant to strike a bridge between financial and impact materiality, but all it does is adding to the materiality madness, making the idea behind the concept of materiality unnecessarily complicated. Of those concepts, dynamic materiality is heard most often. It is based on the primacy of ‘financial materiality’ but has been extended by the notion of ‘pre-financial information’. The point of departure is that some sustainability issues have no direct monetary impact on the company’s financial value creation in the here and now, but may do so in the medium or long term. Blurring the boundaries between financial and impact materiality, by stating that some information is dynamic rather than static, complicates the way substance should be given to sustainability disclosures. The concept of dynamic materiality is basically a postponement of double materiality due to, at the end of the day, companies should report on matters that influence enterprise value (financial materiality) and matters that affect the economy, environment, and people (impact materiality). The reality is that the impacts of an organization are or will become financially material over time. Without understanding these impacts, it won’t be possible to get a complete overview of financially material issues affecting the company, an exercise that GRI supports. Besides, impact reporting is also highly relevant in its own right as a public interest activity for multiple stakeholders. The impacts of a company matter and must be reported even if the company or its investors do not consider them to be financially material, either now or in the future. That is to say two sustainability reporting developments are happening that take a different approach on materiality. 1. The European Sustainability Reporting Standards (ESRS) being created by the EU will be based on double materiality, for a multi stakeholder audience (which includes investors). GRI and the European Financial Reporting Advisory Group (EFRAG) are leading its co-construction efforts. 2. The standards for the disclosure of sustainability-related financial information are being drafted by the IFRS Foundation will be based on financial materiality for an investor audience only. In GRI’s perspective, the approaches of the IFRS and the EU are not competing but complementary forces. Different standards have different purposes for different audiences. In conclusion, the GRI Standard is currently the only global standard with an exclusive focus on impact reporting for a multi-stakeholder audience – making it an essential factor in the shaping of a reporting structure based on double materiality (GRI, 1., 2022).

The widely supported neoliberal economic view, especially popular since the 1980s, entails that a company is accountable only to the shareholders and investors. In this context, ‘profit maximalization’ is the company’s principal duty. Social matters are the responsibility of the government. At present, there are many who believe this view (in its extreme form) is no longer tenable. The objective of value creation by the company (purely) for the benefit of shareholders is moving towards a broader view, which takes account of social engagement and the impact on climate and society for a larger group of stakeholders. According to these topics are shifted market overview that will affect your reputation and brand, your ability to hire staff, mitigate and manage environmental risks (within the value and supply chain) and your access to capital markets. Recent milestones in this movement include The New Paradigm of Corporate Governance from the International Business Council of the World Economic Forum (WEF), the subsequent 2020 Davos Manifesto, as well as the adoption of stakeholder governance by the American Business Roundtable. Therefore, the real meaning of stakeholders should be reidentified. An interest (stake) is something of value to an individual or group, that can be affected by the activities of an organization. So, there are many individuals and groups either human or non-human that have the potential to be affected, for example: business partners, civil society organizations, consumers, customers, employees, governments, local communities, NGOs, shareholders and investors, suppliers, trade unions, and vulnerable groups etc. Together we call them stakeholders. The balancing act businesses face in a stakeholder centric economic model is to remain attractive to investors while taking into account the interests of your stakeholders. Alas, that is not an easy thing to do. First of all, you cannot please everyone. Secondly, you need to make money to stay competitive. Some business decisions may conflict with certain stakeholder’s interests. Hence, explaining to stakeholders your actions to become (more) profitable while (trying to) safeguard their interests is a powerful tool to show the world your contribution to the economy, environment and society. That is where financial reporting standards and GRI’s sustainability reporting standards come into play. The needs of the world’s economy, its people and environment go beyond climate metrics or investor interest alone. The topics of the top-10 most downloaded GRI Standards in 2021 clearly reflect this as shown in Figure 3. These numbers prove that there is broader interest in sustainability issues. Moreover, companies around the world are not all impacted by environmental issues to the same extent, with many organizations facing relatively higher-pressure levels on social and governance matters.

Figure 3 (GRI, 2., 2022, 2)

GRI bringing stakeholder capitalism into practice by suggested that the objective to generate profit should not be dismissed given that companies play an essential role in the creation of jobs and developing and scaling innovative technologies, which are crucial as the world seeks to shift from fossil to renewable energy. However, companies also need to set targets that are aligned to their sustainability impacts, including the Sustainable Development Goals (SDGs). Applying comprehensive sustainability reporting and financial reporting means the company, asset manager, asset owner or rating agency can legitimately respond to calls for an approach that reflects both their profit-making mandate as well as responsibilities to the environment and society. That is why GRI is a firm supporter in the creation of a comprehensive corporate reporting system based on a two-pillar structure – for financial and sustainability reporting – with each pillar on an equal footing and mandated. (GRI, 2., 2022).

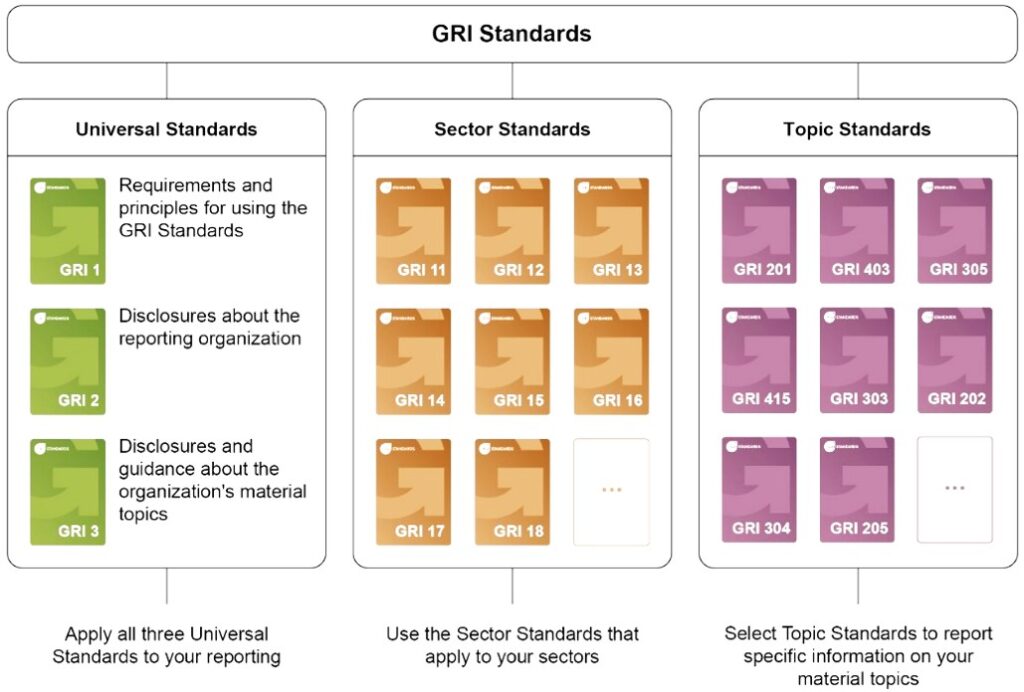

The GRI Standards enable any organization – large or small, private or public – to understand and report on their impacts on the economy, environment and people in a comparable and credible way, thereby increasing transparency on their contribution to sustainable development. In addition to companies, the Standards are highly relevant to many stakeholders – including investors, policymakers, capital markets, and civil society.

Figure 4 (GRI, 1., 2023)

· The Universal Standards – now revised to incorporate reporting on human rights and environmental due diligence, in line with intergovernmental expectations – apply to all organizations;

· The new Sector Standards – enable more consistent reporting on sector-specific impacts;

· The Topic Standards – adapted to be used with the revised Universal Standards – list disclosures relevant to a particular topic.

Access an overview of how the Standards are set up and what to look for in the reporting process with this short introduction: Get to know the GRI Standards system (GRI, 1., 2023)

Recent Articles