Task Force on Climate Change-Related Financial Disclosure (TCFD) was formed by the Financial Stability Board (FSB) from Basel, Switzerland, which is an international body that seeks to strengthen and protect global financial markets from systematic risks such as climate change. The FSB’s structure is a framework for the identification of systemic risk in the financial sector, for framing the policy sector, and policy actions that can address these risks, and for overseeing implementation of those responses (FSB, 2020). The members of FSB, who committed to TCFD, comprise of 24 nations including 1) Argentina 2) Australia 3) Brazil 4) Canada 5) China 6) France 7) Germany 8) Hongkong SAR 9) India 10) Indonesia 11) Italy 12) Japan 13) Korea 14) Mexico 15) Netherland 16) Russia* (not participate in FSB meetings at present) 17) Saudi Arabia 18) Singapore 19) South Africa 20) Spain 21) Switzerland 22) Turkey 23) United Kingdom 24) United State of America, and 13 organizations including 1) International Monetary Fund (IMF) 2) The World Bank 3) Bank of International Settlements (BIS) 4) Organization for Economic Cooperation and Development (OECD) 5) European Central Bank (ECB) 6) ECB Banking Supervision (SSM) 7) European Commission 8) Basel Committee on Banking Supervision (BCBS) 9) International Association of Insurance Supervisors (IAIS) 10) International Organization of Securities Commissions (IOSCO) 11) International Accounting Standard Board (IASB) 12) Committee on the Global Financial System (CGFS) 13) Committee on Payments and Market Infrastructures (CPMI) (FSB, 2023).

The FSB established the Task Force on Climate-related Financial Disclosures (TCFD or Task Force) to develop recommendations for more effective climate-related disclosures that: 1) could “promote more informed investment, credit, and insurance underwriting decisions” and 2) on the other hand, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks. The Task Force identified several categories of climate-related risks and opportunities. These include potential financial impact to assist investors, and companies consider longer-term strategies and most efficient allocation of capital in light of “the potential economic impacts of climate change”. TCFD recommended disclosures into 4 thematic areas 1) Governance: Disclosure the organization’s governance around climate-related risks and opportunities. 2) Strategy: Disclosure the actual and potential impacts of climate-related risks and opportunities on the organizational’ s business, strategy, and financial planning where such information is material. 3) Risk Management: Disclosure how to organization identifies, assesses, and manages climate-related risks. 4) Metrics and Targets: Disclosure the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material (TCFD, 2022).

The first key consideration for prepare disclosures is the Principles for Effective Disclosures in which influences high-quality and decision useful disclosure that enable stakeholders to understand the impact of climate change on organizations. The TCFD recommended The Principles for Effective Disclosures including 7 concerns: 1) Disclosures should represent relevant information 2) Disclosures should be specific and complete 3) Disclosures should be clear, balanced, and understandable 4) Disclosure should be consistent over time 5) Disclosures should be comparable among companies within a sector, industry, or portfolio 6) Disclosures should be reliable, verifiable, and objective 7) Disclosure should be provide on a timely basis. Secondly, the Cross-Industry Metric Categories is a set of climate-related metric categories that all organizations should disclose, where data and methodologies allow. For example, A printing company, which familiar with printing process, may adopt a building rating system for identifying GHG from company’s building despite of GHG from printing process. However, the extract metrics and units of measure to be used are not prescribed in the Cross-Industry Metric Categories in order to allow organizations, industries, standard setters, and jurisdictions to develop specific climate-related metrics within those defined categories along with specific climate-related risk issues in each micro climate area. The third key consideration is the Financial Sector Metrics, which provides specific considerations for financial sector organizations due to the nature of their business activity. Another key consideration is the Transition Plans that ask for disclosure of the actual and potential impacts of climate-related risk and opportunities on the organization’s businesses, strategies, and financial planning, reporting on transition plans. The final one is the Implementation Over Time according to different organizations require vary resources, budgets and timing for producing disclosures, hence each organization should update the guidance continually.

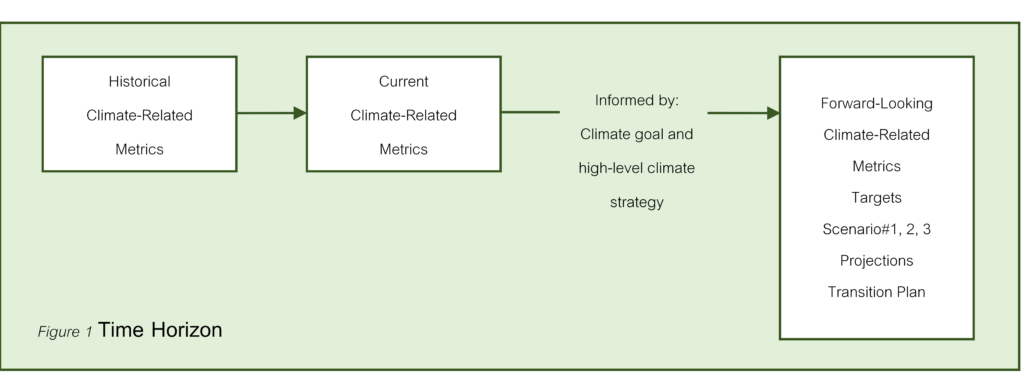

In terms of climate-related metrics, there are 3 “connective tissue” for connect those 4 thematic areas, which are mentioned above, comprise of 1) characteristics of effective climate-related metrics 2) Disclosing climate-related metric 3) driving toward comparability: cross industry metric categories. For the first one, TCFD described the character of reporting that ought to be. Firstly, organizations should elaborate about climate-related metrics that how it relates to organization, what are risks and opportunity of those metrics, and show how the organizations manage such risks and opportunities as part of governance, strategies, and risk management processes. This stage helps stakeholders to understand potential impacts of climate-related risks and opportunities over a specific time period, including financial impacts and operational consequences. Disclosure of climate-related metrics will be most effective when metrics are presented in manner that aids understanding including clear articulation of any limitations and caution. Climate-related metrics should also provide important context around such points as management’s thinking in terms of goal setting, internal process management, and communication objectives and should be supported by contextual and supporting narrative information on items such as organizational boundaries, governance, methodologies, and basis of preparation. The climate-related metrics support effective internal control for purposes of data verification and assurance. Hence. Climate-related metrics should be free from bias and value judgement so that they yield an objective disclosure of performance that stakeholders can leverage regardless of their worldview or outlook. In consistency of over time, there are three time horizons that are relevant to climate-related metrics: current, historical, and forward-looking, which are identified as: Current period data, outlining most recent reporting period and covering the same period as the current period in the organization’s financial filings (e.g., 12 months year to date). Historical, data for the period(s) prior the current year period, covering at a minimum the same period as in the organization’s financial fillings. Forward-looking is future period data, covering shot-, mid-, and long-term time horizons. Forward-looking metrics may be based on methodologies such as scenario analysis, trend analysis, sensitivity analysis, and simulations, as well as commitments and climate-related targets as shown in Figure 1. Unlikely historical and current data, forward-looking data are usually more appropriately reported as ranges based on assumptions about the future state of the world, often tied to one or more probable climate scenarios. Importantly, climate-related metrics are most effective when the same item is reported across all time periods. Measuring the same metrics over time period is a key to track progress. Disclosure of GHG emissions, for example, could include data on the organization’s previous GHG emissions levels, the amount of GHG emissions in the organization’s current reporting period – including an indication of progress against GHG-specific targets – and a forward-looking range for future GHG emissions.

For the second one, contextual and supporting narrative can help to create effective disclosure of climate-related metrics in general. Climate-related metrics, and associated narrative should be integrated with an organization’s other disclosures to provide a coherent set of information on the organization’s climate-related risk and opportunities and actual and potential financial impact. Organizations should also consider presenting climate-related metrics and associated contextual information with ranges or qualitative categories including confidence associated with the value of metrics. The first consideration is types of measurements used that include whether information comes from direct measurement, estimates, proxy indicators, or financial and management accounting processes. Methodologies and definitions used is another consideration, which include the scope of application, data sources, critical factors or parameters, assumptions, and limitations of the methodology. For example, the GHG protocol suggests that organizations discuss GHG emission factors, scope, and boundaries etc. For metrics informed by scenario analysis, organizations should include information on which climate scenarios were used and their assumptions and limitations as elaborate in Table 1. Organization should also provide context if they adjust the methodology or definition of particular metrics. Thirdly, trend data is another consideration for considering of how metrics have changed in absolute and relative amounts over time, including whether acquisitions, divestments or policies have affected results. The fourth consideration is how results are connected with business units, company strategy, and financial performance and position. Where it helps understanding, organizations should consider disaggregating information by categories such as geographical area, business unit, asset, type, upstream and downstream activities, source, and vulnerability of area. The fifth consideration is how value chains will be affected over time by climate-related transition and physical risks, including life cycle GHG emission reporting. The final consideration for disclosing climate-related metrics is reconciliation with financial accounting standard, if needed. If climate-related metrics are presented in financial terms, disclosures should clarify how such metrics reconcile with financial accounting standards and explain any differences.

Importance of Disclosing Details on Climate-Related Scenario Analysis

| Disclosure Category | Purpose |

|---|---|

| Governance – Board oversight of strategy and scenario process | • Indicate and awareness and understanding of climate-related issues; level of expertise on or available to the Board on climate issues; reporting relationships to the Board regarding scenario analysis. |

| Risk Management | • Including the risks and uncertainties evaluated through scenario analysis; how the company believes these risks may develop over time based on scenario analysis; how the company plans to manage or address their risks. |

| Strategy – Scenario analysis process | • Describe processes used for scenario analysis; the range and assumptions of scenarios used; key finding, whether it is a standalone analysis or integrated with company’s risk management and strategy processes. |

| Strategy -Strategy resilience | • Indicate awareness and planning for the potential physical climate and transitional changes indicated by scenario analysis; indicate adjustments made to strategy in light of scenario analysis. • Indicate whether financial plans are aligned with strategic plans related to climate risks and opportunities (e.g., capital expenditure, investments, R&D, etc.) |

| Target and Metrics | • Indicate whether useful metrics have been identified related to strategy, strategy resilience, and scenario signposting; how these metrics are connected to the organization’s strategy and scenario analysis; and how they are being used |

Table 1 (TCFD, 2020, 45)

Remark: Using a common set of scenarios and inputs (e.g., parameters, timelines, industry-specific metrics, methodologies) increases comparability across companies, provides greater reliability and relevance, and can help reduce the resources required by preparers to develop scenarios in- house. On the other hand, using a common set of scenarios across organizations may reduce their ability to assess their individual situations and how climate-related risks may uniquely affect them, and thus could increase concentration of risk.

Driving toward comparability is the third connective tissue that help the disclosure get aligned with global trend. Climate-related metrics can be generally categorized into 2 groups – those that apply to all organizations (cross-industry) and those that are specific to an industry (industry specific). These 2 types of climate-related metrics can be referred to the International Sustainability Standards Board (ISSB) that established by the IFSC Foundation. The Task Force recommends that preparers disclose metrics consistent with the cross- industry, climate-related metric categories for the current, historical, and forward-looking periods. It is also important to note that the recommended disclosures within both the Strategy and Metrics and Targets recommendations are subject to materiality, except for the disclosure of Scope 1 and Scope 2 GHG emissions. Organizations typically use a wide variety of information internally and externally to manage their operations. These cross-industry, climate-related metric categories are not meant to supplant or replace other information that organizations track as part of their business planning or that industries converge on to track climate-related risks or opportunities specific to their industry or organization. 7 Cross-Industry, Climate-Related Metric categories and examples are described in Table 2. (TCFD, 2021)

| Metric Category | Example Unit of Measure | Example Metrics |

|---|---|---|

| GHG Emissions Absolute Scope 1, Scope 2, and Scope 3, emission intensity | MT of CO2e | • Absolute Scope 1, Scope 2, and Scope 3 GHG emission • Financed emissions by asset class • Weighted average carbon intensity • GHG emission per MWh of electric produced • Gross global Scope 1 GHG emissions covered under emission-limiting regulations |

| Transition Risks Amount and extent of assets or business activities vulnerable to transition risks* | Amount or percentage | • Volume of real estate collaterals highly exposed to transition risk (General industry) • Concentration of credit exposure to carbon-related assets (General industry) • Percent of revenue from coal mining (Energy industry) • Percent of revenue passenger kilometers not covered by Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) (Aviation industry) |

| Physical Risks Amount and extent of assets or business activities valuable to physical risks* | Amount or Percentage | • Number and value of mortgage loans in 100-year flood zones • Wastewater treatment capacity located in 100-year flood zones • Revenue associated with water withdrawn and consumed in regions of high or extremely high baseline water stress • Proportion of property, infrastructure, or other alternative asset portfolios in an area subject to flooding, heat stress, or water stress • Proportion of real assets exposed to 1:100 or 1:200 climate-related hazards |

| Climate-Related Opportunities Proportion of revenue, assets, or other business activities aligned with climate-related opportunities | Amount or percentage | • Net premiums written related to energy efficiency and low-carbon technology • Number of 1) zero-emissions vehicles (ZEV), 2) hybrid vehicles, and 3) plug-in hybrid vehicles sold (PHEV) • Revenues from products or services that support the transition to a low-carbon economy • Proportion of homes delivered certified to a third-party, or multi-attribute green building standard |

| Capital Deployment Amount of capital expenditure, financing, or investment deployed toward climate-related risks and opportunities | Reporting currency | • Percentage of annual revenue invested in R&D of low-carbon products/services • Investment in climate adaptation measures (e.g., soil health, irrigation, technology) |

| Internal Carbon Prices Price on each ton of GHG emissions used internally by an organization | Price in reporting currency, per MT of CO2e | • Internal carbon price • Shadow carbon price, by geography |

| Remuneration Proportion of executive management remuneration linked to climate consideration** | Percentage, weighting, description, or amount in reporting currency | • Portion of employee’s annual discretionary bonus linked to investments in climate-related products or services • Weighting of climate goals on long-term incentive scorecards for Executive Directors • Weighting of performance against operational emissions’ targets for remuneration scorecards |

Table 2 (TCFD, 2021, 16-17)

*Transition and physical risks: Due to challenges related to portfolio aggregation and sourcing data from companies or third-party fund managers, financial organizations may find it more difficult to quantify exposure to climate-related risks. The Task Force suggests that financial organizations provide qualitative and quantitative information, when available.

**Remuneration: While the Task Force encourages quantitative disclosure, organizations may include descriptive language on remuneration policies and practices, such as how climate change issues are included in balanced scorecards for executive remuneration.

Recent Articles