the Most Renowned ESG Guidance Framework: International Integrated Reporting Council (IIRC)

The International Integrated Reporting Council (IIRC) was found in August 2010 and aims to create a globally accepted framework for process that results in communications by an organization about value creation over time. The IIRC Board of Directors oversaw the strategy, finances, and operations of the organization and appointing members of the International Integrated Reporting Framework Board. The International Integrated Reporting Framework Board recommended any revision, modification or other updates to the International Integrated Reporting Framework Council. The Council was the primary institutional forum for expression of the broad market view on matters relating to integrated reporting and integrating thinking, as well as a medium for its interaction and provision of advice, guidance and input on issues of relevance for the organization, including its nature, objectives, purpose, vision and mission, as well as its strategy and the means by which to deliver integrated reporting framework to the market (Integrated Reporting, 1., 2023). In November 2011, the IIRC announced a number of changes to its organizational structure according to its complexity. Under the new arrangements, an initial transitional phase until the end of 2013 will see the IIRC supported by a strengthened secretariat operating through a not-for-profit company established for the purpose under the same name. A Governance Committee has also been established for replacing the original, with responsibilities relating to audit, nominations, and executive remuneration for the company. At this point, the IIRC Created the foundations for a new reporting model to enable organizations to provide concise communications of how they create value overtime in 2014. The IIRC refers to this process as Integrated Reporting, which it stylizes as <IR>. <IR> structured around the organization’s strategic objectives, its governance, and business model and integrating both financial and non-financial information. The objectives for an integrated reporting framework are to:

- Support the information needs of long-term investors, by showing the border and long-term consequences of decision making

- Reflect the interconnections between environmental, social, governance and financial factors in decisions that affect long-term performance and condition, making clear the link between sustainability and economic value

- Provide the necessary framework for environmental and social factors to be taken into account systematically in reporting and decision making

- Rebalance performance metrics away from an undue emphasis on short term financial performance

- Bring reporting closer to the information used by management to run the business on day-to-day basis

(UK Accounting Plus, 2023) and <IR> aims to:

- Improve the quality of information available to providers of financial capital to enable a more efficient and productive allocation of capital

- Promote a more cohesive and efficient approach to corporate reporting that draws on different reporting strands and communicates the full range of factors that materially affect the ability of an organization to create value over time

- Enhance accountability and stewardship for the broad base of capitals (financial, manufactured, intellectual, human, social and relationship, and natural) and promote understanding of their interdependencies

- Support integrated thinking, decision-making and actions that focus on the creation of value over the short, medium and long term.

The <IR> framework is divided into 3 parts including Fundamental Concepts, Guidance Principles, and Content Elements. Firstly, the Fundamental Concepts underpin and reinforce the requirements and guidance in the <IR> Framework. It explains how an organization crates, preserves, or erodes value over time. Value is not created, preserved, or eroded by or within an organization alone, it is influenced by the external environment though. It, in addition, is created through relationships with stakeholders on various resources as following:

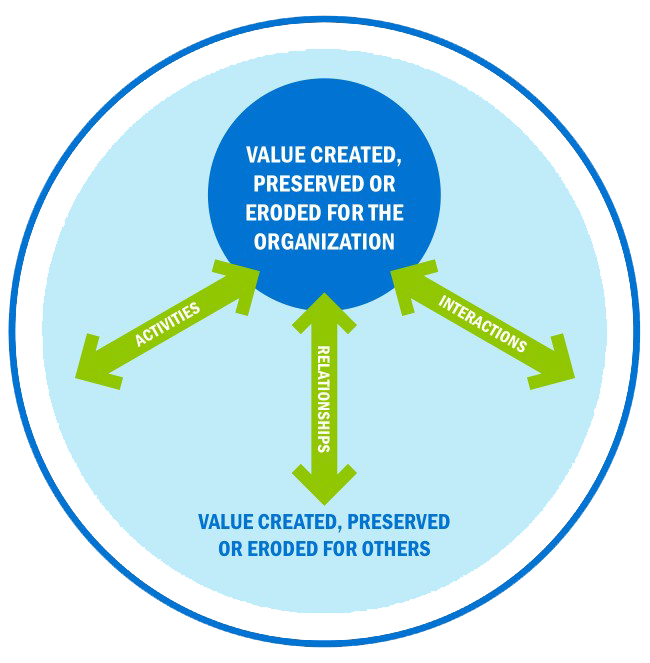

- Value creation, preservation or erosion for organization and for others Value created, preserved or eroded by an organization over time manifests itself in increases, decreases or transformations of the capitals caused by the organization’s business activities and outputs. The ability of an organization to create value for itself is linked to the value it creates for others. As illustrated in Figure 1

Figure 1

- The capitals All organizations depend on various forms of capital for their success. In the <IR> Framework, the capitals comprise financial, manufactured, intellectual, human, social and relationship, and natural

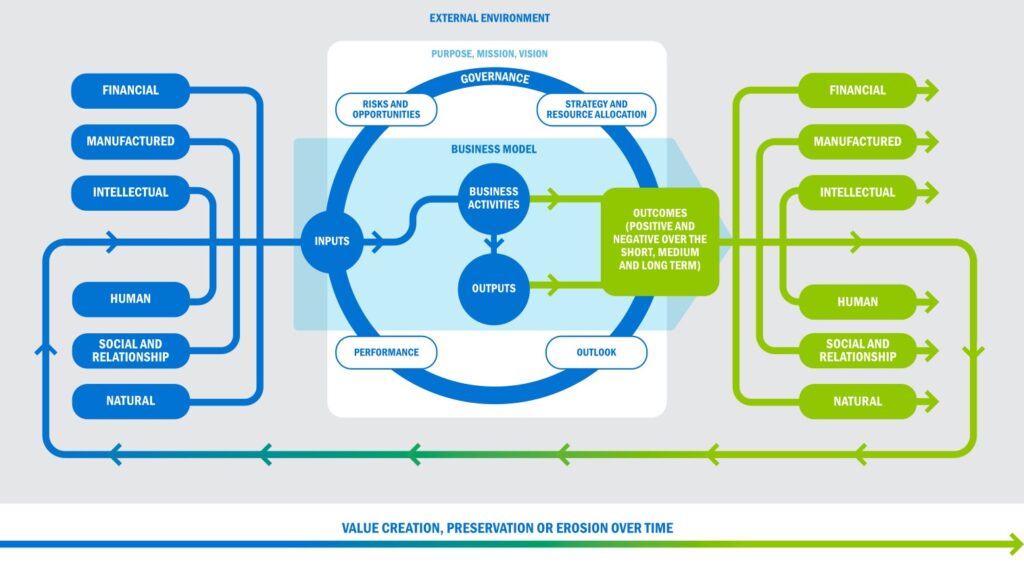

- Process through which value is created, preserved, or eroded although organizations aim to create value, the overall stock of capitals can also either undergo a net decrease or experience no net change. In such cases, value is eroded or preserved. The process through which value is created, preserved or eroded is depicted in Figure 2 (Integrated Reporting, 2., 2021)

Figure 2

7 combination guidance principles underpin the operation and presentation of an integrated report, informing the content of the report and how information is presented:

- Strategic focus and future orientation. An integrated report should provide insight into the organization’s strategy, and how it relates to the organization’s ability to create value in the short, medium and long term, and to its use of and effects on the capitals

- Connectivity of information. An integrated report should show a holistic picture of the combination, interrelatedness and dependencies between the factors that affect the organization’s ability to create value over time

- Stakeholder relationships. An integrated report should provide insight into the nature and quality of the organization’s relationships with its key stakeholders, including how and to what extent the organization understands, takes into account and responds to their legitimate needs and interests

- Materiality. An integrated report should disclose information about matters that substantively affect the organization’s ability to create value over the short, medium and long term

- Conciseness. An integrated report should be concise

- Reliability and completeness. An integrated report should include all material matters, both positive and negative, in a balanced way and without material error

- Consistency and comparability. The information in an integrated report should be presented: (a) on a basis that is consistent over time; and (b) in a way that enables comparison with other organizations to the extent it is material to the organization’s own ability to create value over time.

The <IR> also comprises of 8 content elements that are fundamentally linked to each other and are not mutually exclusive:

- Organizational overview and external environment. What does the organization do and what are the circumstances under which it operates?

- Governance. How does the organization’s governance structure support its ability to create value in the short, medium and long term?

- Business model. What is the organization’s business model?

- Risks and opportunities. What are the specific risks and opportunities that affect the organization’s ability to create value over the short, medium and long term, and how is the organization dealing with them?

- Strategy and resource allocation. Where does the organization want to go and how does it intend to get there?

- Performance. To what extent has the organization achieved its strategic objectives for the period and what are its outcomes in terms of effects on the capitals?

- Outlook. What challenges and uncertainties are the organization likely to encounter in pursuing its strategy, and what are the potential implications for its business model and future performance?

- Basis of presentation. How does the organization determine what matters to include in the integrated report and how are such matters quantified or evaluated?

In 2021, the IIRC merged with the Sustainability Accounting Standard Board (SASB) Foundation into the Value Reporting Foundation (VRF). The IIRC Board of Directors and the SASB Foundation Board of Directors combined to form the Value Reporting Foundation Board of Directors (“the VRF Board”). A governing board, the VRF Board was responsible for overseeing the strategy, finances, and operations of the organization and appointing members of the International Integrated Reporting Framework Board (IIRF) (Integrated Reporting, 2021). Then in 2022, The IFRS Foundation announced the completion of the consolidation of the Value Reporting Foundation (VRF) into the IFRS Foundation. The IFRS Foundation’s International Accounting Standards Board (IASB) and the International Sustainability Standards Board (ISSB) will work together to agree on how to build on and integrate the Integrated Reporting Framework into their standard setting projects and requirements. It follows the commitment made at COP26 to consolidate staff and resources of leading global sustainability disclosure initiatives to support the IFRS Foundation’s new International Sustainability Standards Board’s (ISSB) work to develop a comprehensive global baseline of sustainability disclosures for the capital markets. The <IR> helps businesses think holistically about their strategy to build investor and key stakeholder confidence and improve future performance. With integrated reporting now being adopted in 75 countries worldwide, by over 2,500 organizations and with support from 40 stock exchanges and counting, more and more organizations are experiencing its benefits for business decision-making and long-term value creation. (Integrated Reporting, 3., 2021).

References:

- UK Accounting Plus (2023) International Integrated Reporting Council (IIRC). [online] London: Deloitte. Available from https://www.iasplus.com/en-gb/resources/global-organisations/iirc [Access 21 June 2023].

- Integrated Reporting, 1. (2023) Governance Archive. [online] Delaware: Integrated Reporting (now part of IFRS Foundation). Available from: https://www.integratedreporting.org/the-iirc-2/governance-archive/ [Access 21 June 2023].

- Integrated Reporting, 2. (2021) International <IR> Framework. [online] Delaware: Integrated Reporting (now part of IFRS Foundation). Available from: https://www.integratedreporting.org/resource/international-ir-framework/ [Access 21 June 2023].

- Integrated Reporting, 3. (2021) Transition to Integrated Reporting: A Guide to Getting Started. [online] Delaware: Integrated Reporting (now part of IFRS Foundation). Available from: https://www.integratedreporting.org/news/transition-to-integrated-reporting-a-guide-to-getting-started/ [Access 21 June 2023].