the Most Renowned ESG Guidance Frameworks: Value Reporting Foundation (VRF)

The VRF’s SASB Standards serve as a key starting point for the development of the IFRS Sustainability Disclosure Standards, while the Integrated Reporting Framework provides connectivity between financial statements and sustainability-related financial disclosures. The consolidation delivers on market demand—including from companies, investors and regulators—for simplification of the sustainability disclosure landscape, and follows the consolidation of the Climate Disclosure Standards Board (CDSB) into the IFRS Foundation (IFRS, 1., 2022). The VRF unites the IIRC’s historic focus on enabling management and business decision-making with SASB’s historic focus on enabling investor decision-making. The two organizations share a core belief that external reporting can create a common language among businesses and investors and help both businesses and investors understand how value is created, preserved or eroded over time. The Value Reporting Foundation’s three resources comprise a robust toolset:

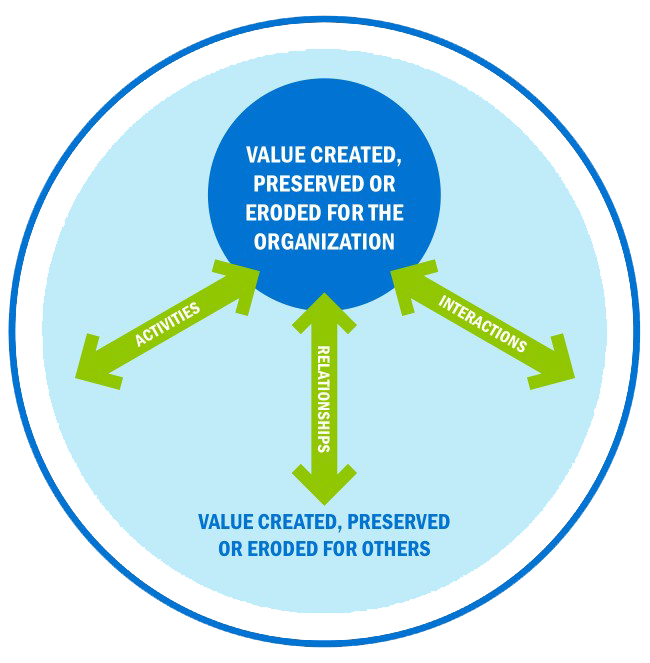

- Integrated Thinking Principles drive an improved understanding of how value is created, to enhance decision-making and actions by boards and management. Through integrated thinking, organizations are better placed to tailor their business model and strategy to respond to the external environment and understand risks and opportunities.

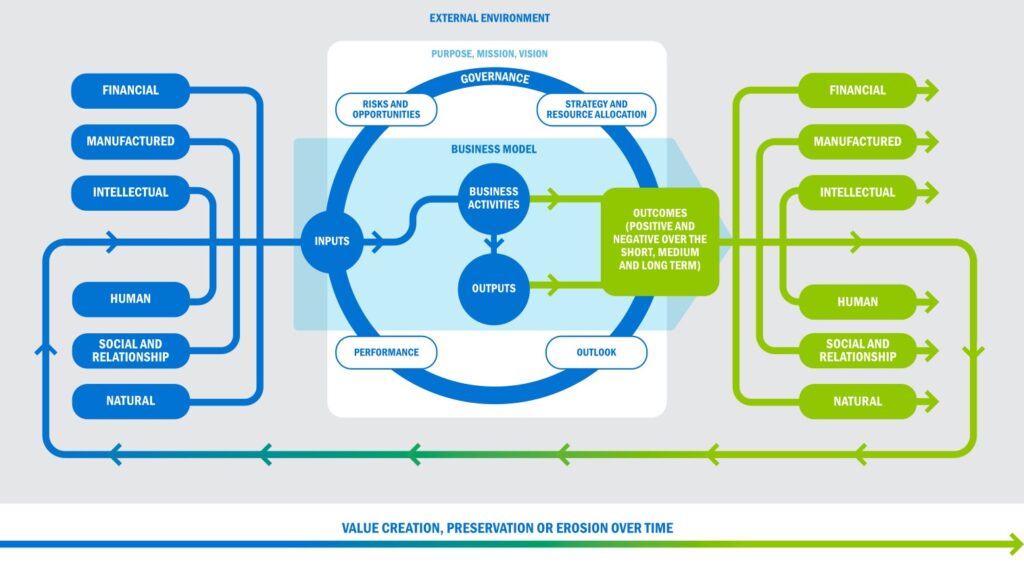

- <IR> Framework is a principles-based framework that guides effective communication on strategy, governance, performance and prospects through a multi-capital lens, enabling a single integrated report that communicates a business’s holistic value.

- SASB Standards provide detailed industry-specific sets of disclosure topics and metrics to inform what content to include in an integrated report, lending insight into performance on the subset of sustainability issues that are most closely tied to an organization’s ability to create long-term value, and thus most of interest to investors.

When used together, tools from the Value Reporting Foundation create a perpetual feedback loop, enabling businesses and investors to more effectively communicate on enterprise value and how it is created, preserved or eroded over time. Across the globe, organizations are increasingly leveraging the complementary benefits of the <IR> Framework and SASB Standards as shown in Figure 1.

Figure 1

Clarifying compatibility across the Value Reporting Foundation Tools

The <IR> Framework and the SASB Standards are complementary, and many businesses use both to fulfill their reporting needs. The tools provide a powerful structure for reporting qualitative context and activity alongside quantitative industry-specific metrics. Within the growing field of sustainability-related disclosure, frameworks and standards have been developed to help establish a foundational layer of relevant, comparable and reliable information from companies. Each serves a unique purpose to help companies understand and report on critical drivers of long-term value.

- Disclosure frameworks, including the <IR> Framework, provide broad content and presentation requirements through a principles-based approach.

- Disclosure standards, including SASB Standards, provide replicable and detailed requirements for what should be reported for specific topics. Standards support frameworks by ensuring comparable, consistent and reliable information.

The <IR> Framework helps companies explain how they create, preserve or erode value. Applying well-defined Guiding Principles and Content Elements, integrated reports look beyond financial performance alone to demonstrate how businesses manage up to 6 forms of capital: financial, manufactured, intellectual, human, social and relationship, and natural. Integrated reporting offers internal and external benefits. Internally, it builds communication and coordination across departments. It improves internal decision-making through building a deeper understanding of the resources and relationships that are critical to the long-term success of the business. Integrated reporting also enables an organization to evaluate its governance, performance and prospects in the context of the external environment, and provide investors and other users of integrated reports with a more holistic view of the business. SASB Standards complement the <IR> Framework’s principles-based approach. An integrated report provides essential context to investors, helping them more fully understand the business’ current position, future prospects and the relevant circumstances under which performance has been achieved. This provides investors with insight into the quality of thinking and strategic planning of the board and management. However, an integrated report, a concise and connected narrative, offers valuable explanations and context for the data provided through SASB Standards. On the other hand, SASB Standards identify the subset of environmental, social, and governance (ESG) issues likely to materially impact the financial performance of a typical business in an industry. By starting with this subset of issues, businesses can establish best practices, produce decision- useful reports, and then seek to improve disclosure and performance year on year. Available for 77 industries, SASB Standards provide investors with consistent, comparable and reliable information on the ESG factors most relevant to financial performance and enterprise value. With an average of six disclosure topics and 13 disclosure metrics per industry, the SASB Standards are an accessible starting point for companies beginning their ESG reporting journey. Many businesses using both the <IR> Framework and SASB Standards find that the two tools strengthen one another. Furthermore, SASB Standards provide comparable information on the business-critical risks and opportunities that fall beyond the scope of traditional financial disclosure.

Internal business benefits

The corporate disclosure has been described as complex and confusing for businesses. The breadth of reporting frameworks and standards can strain a company’s resources. Amidst this broad reporting landscape, the <IR> Framework and SASB Standards provide an efficient solution. These tools provide companies with a robust system that integrates sustainability disclosure with financial disclosure practices. The <IR> Framework and SASB Standards provide an accessible starting point to high-quality, investor- focused disclosure. With the <IR> Framework, organizations can understand and communicate how their resources (capitals) are changed through business activities to create value over time. With SASB Standards, companies can report on the ESG information most critical to their industry and enable comparability. While certain information is useful across industries, many sustainability-related value drivers are industry-specific. By adding SASB Standards, reporters provide: 1) industry-specific rigor; 2) quantitative evidence/ support for the integrated report’s narrative claims; and 3) deeper comparability against peers. For example, with SASB Standards, Badische Anilin and Sodafabrik (BASF) can succinctly highlight the sustainability topics most material to the Chemicals industry (such as Hazardous Waste Management), and Unilever, a UK-based consumer goods provider, can do the same for the topics in the Household & Personal Products industry (such as Environmental & Social Impacts of Palm Oil Supply Chain). (SASB Standards, 2021).

External business and investor benefits

With the <IR> Framework and SASB Standards, businesses can provide a more complete picture of long-term value creation while meeting investor needs for comparable, consistent and reliable information. Reporting with both tools can bolster a company’s credibility and trust among its external stakeholders, especially investors and other providers of financial capital. Investors are not monolithic — they have varying strategies and priorities. To best meet investor needs, businesses should engage with their investors directly, understand their priorities, and then tell the company story with that lens in mind. The <IR> Framework and SASB Standards are useful tools to strengthen, enhance and clarify a business’ value creation story. BASF conducted an “ESG to value creation” mapping exercise to help prioritize and disseminate sustainability practices and initiatives. In particular, with the issuance of its first green bond in 2020, BASF found that reporting and performance improvements subsequently increased its access to financial capital. While green bonds are an uncommon offering for a chemical business, BASF turned it into a successful financing tool. In many ways BASF attributes this success to its reporting with the <IR> Framework. Investors credited their support for the BASF green bond to a strong trust in BASF’s business and ESG practices. Investors feedback further underlined that this trust arose from the company’s reporting and how investors are able to see financially-relevant sustainability issues integrated into management of the business. Due to high investor demand for consistent, comparable and reliable ESG data, businesses find that disclosing with SASB Standards has a positive effect on investor relations. Because they are industry-specific, metric-driven and focused on financial materiality, SASB Standards enable integration of ESG considerations into investment and stewardship decisions across global portfolios and asset classes. They also provide comparable data to the data and analytics ecosystem that supports investment decision making.

Communicating Inside and out

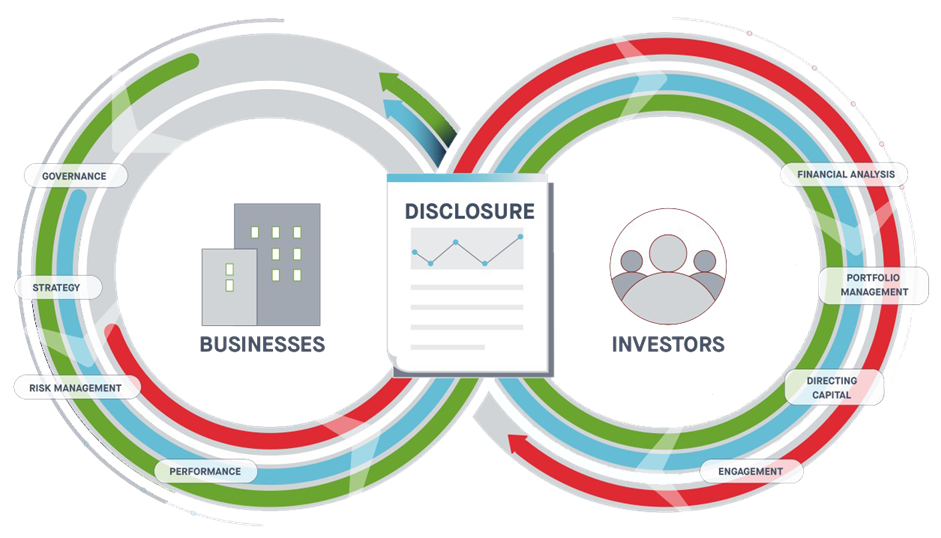

Disclosure with the <IR> Framework and SASB Standards creates a positive feedback loop between businesses and investors. Used in conjunction, this positive feedback loop helps communicate progress and facilitate further improvement over time. When a business is clear about its sustainability objectives, the reporting process, using the <IR> Framework and SASB Standards, creates a positive feedback loop as shown in Figure 2.

Figure 2

Incorporating feedback will look different at every organization. It may result in the review of corporate strategy, adaptation of management systems or evolution of governance processes. In all scenarios, the feedback loop will ensure that resources are allocated efficiently to maximize value over the short, medium and long term. Many businesses describe this holistic approach as integrating ESG or sustainability into their DNA. In the same way that sustainability issues manifest differently for every industry, integrating ESG across internal business units looks different for every business. Disclosure with the <IR> Framework and the SASB Standards is far more than a communications exercise. Within a business, these tools can help break down internal barriers, build connectivity and enhance decision-making. This promotes integrated thinking, a process by which boards and management teams gain new insights into their organization’s value creation process. They improve their understanding of the resources and relationships (or capitals) on which the organization depends, the risks it faces and the financial and non-financial outcomes it generates.

Contributing to a more sustainable future

Disclosure and transparency are a means to an end: more informed business and investment decision making that can lead to improved economic, environmental and societal outcomes. Businesses engaging in sustainability disclosure and integrated reporting are embarking on a continuous journey, an interactive cycle, which benefits their business, their investors, society and the planet as shown in Figure 3.

Figure 3

International References:

- IFRS, 1. (2022) IFRS Foundation Completes Consolidation with Value Reporting Foundation. [online] Delaware: Integrated Reporting (now part of IFRS Foundation). Available from: https://www.ifrs.org/news-and-events/news/2022/08/ifrs-foundation-completes-consolidation-with-value-reporting-foundation/# [Access 21 June 2023].

- SASB Standards (2021) Complementary Tools: Using the <IR> Framework and SASB Standards Together. [online] Delaware: SASB Standards (now part of IFRS Foundation). Available from: https://sasb.org/knowledge-hub/complementary-tools-using-the-framework-and-sasb-standards-together/ [Access 21 June 2023].