the Most Renowned ESG Voluntary Frameworks: Global Real Estate Sustainability Benchmark (GRESB)

GRESB is the global ESG benchmark for financial markets, which is established in 2009 and composed of an independent foundation and a benefit corporation. The GRESB Foundation focuses on the development, approval and management of the GRESB Standards while GRESB BV performs ESG assessments and provides related services to GRESB Members. GRESB is a mission-driven and industry-led organization that provides actionable and transparent environmental, social and governance (ESG) data to financial markets. The 2022 real estate benchmark covers more than 1,800 property companies, real estate investment trusts (REITs), funds, and developers. In addition, GRESB coverage for infrastructure includes over 800 infrastructure funds and assets. Combined, GRESB represents USD 8.6 trillion in real asset value. More than 170 institutional investors use GRESB data to monitor their investments, engage with their managers, and make decisions that lead to a more sustainable real asset industry. Led by a Foundation Board composed of representatives from GRESB Members and Partners, the GRESB Foundation is the primary platform for GRESB to engage with the industry, owning and governing the standards upon which GRESB BV – a separate profit-for-purpose benefit corporation – performs its assessments. The GRESB Foundation, GRESB BV and GRESB Members work as one to deliver a shared vision of an investment community that plays a central role in creating a more sustainable world, one where society can meet the needs of the present without compromising the ability of future generations to meet theirs. As an independent standards-setting body, the GRESB Foundation works to develop, maintain, improve and publish GRESB Standards annually, in time for GRESB BV to perform its assessments.

Specifically, the GRESB Foundation:

- Facilitates active industry engagement and consensus on the GRESB Standards

- Ensures that the standards are feasible and can be practically implemented

- Provides inclusive representation across GRESB Members and Partners

- Ensures that the standards continually evolve to advance the foundation’s mission

The GRESB Standards are a set of guidelines to assess and benchmark ESG and related performance of real and other assets. The Standards include the questions, evidence and indicators to assess ESG performance, including the weighting of the indicators. On 14 September 2022, the GRESB Foundation Board approved all the recommended changes for the 2023 GRESB Standards. This is an important outcome of the new GRESB Standards Development Process, which puts the voice and priorities of GRESB members and partners at the forefront of the global ESG realm (GRESB 1, 2023).

Stakeholder Engagement

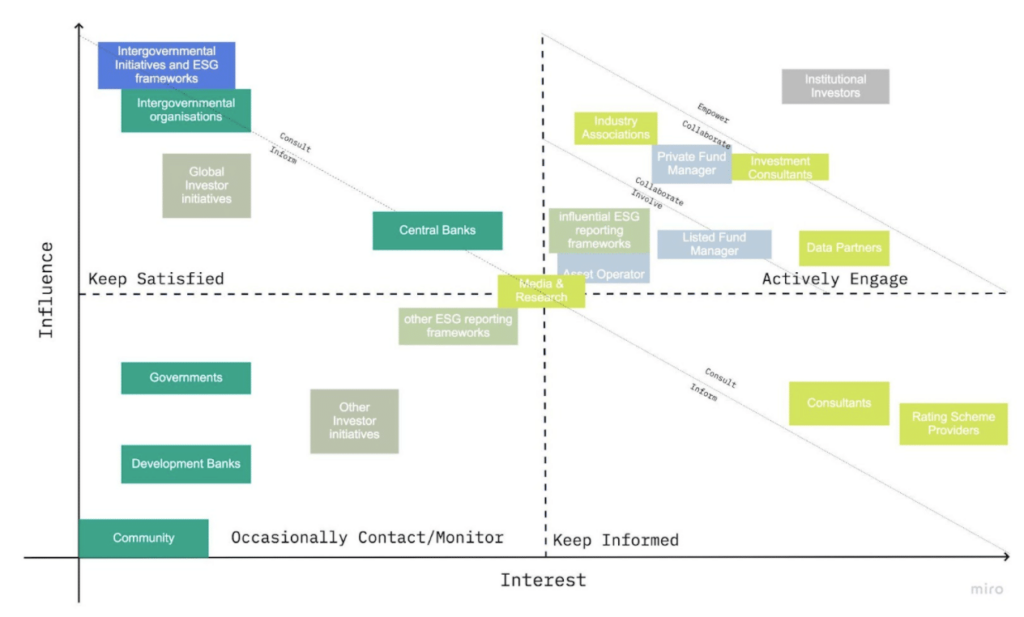

GRESB’s stakeholder engagement strategy is built on the AA1000 AccountAbility Stakeholder Engagement Standard (2015) and references the ISEAL Alliance Standard-setting Code of Good Practice, which defines how a sustainability standard should be developed, structured and improved over time. To ensure stakeholder engagement is embedded across the organization, GRESB have committed to the AccountAbility principles of inclusivity, materiality, responsiveness and impact. For GRESB, the stakeholder landscape is complex, with some stakeholder groups overlapping others in terms of roles and responsibilities:

- Investors, both institutional investors (pension funds, insurance companies, sovereign wealth funds) and other investors (banks, family offices, endowments, etc.)

- Real estate & infrastructure entities, including listed property companies, developers, REITs and private funds

- Industry associations, such as APREA (Asia Pacific Real Estate Association), ANREV (Asian Association for Investors in Non-Listed Real Estate Vehicles) or ARES Management Corp

- Institutions like development banks, central banks, governments, and inter-governmental organizations

- ESG framework providers, from both NGOs and the private sector

- Inter-governmental initiatives, such as those related to the United Nations

- Investor initiatives

- Green Building Councils

- Certification or rating scheme providers

- Consultants either organization or individual

- Media and research organizations

According to GRESB plays an important role within the world of sustainable real assets, and critically engage with the many stakeholders that operate in the ESG space. That said, they cannot and should not engage every stakeholder in the same way or at the same level. Therefore, an “interest-influence” grid helps illustrate our approach, which shows active engagement with GRESB Investor Members, Participant Members and Partners, which is done primarily through the GRESB Foundation as shown in Figure 1.

Figure 1

It can be seen that “influential ESG reporting frameworks” are among our most important stakeholders, just below our own members and partners. For these frameworks, we create bilateral partnerships and engage through representation on various committees and working groups such as Principles for Responsible Investment (PRI) The Global Reporting Initiative (GRI), The Sustainability Accounting Standards Board (SASB), The International <IR> Framework, EU Sustainable Finance Disclosure Regulation (SFDR), Task Force on Climate-related Financial Disclosures (TCFD), Carbon Disclosure Project (CDP) (GRESB 2, 2023). Especially, The EU’s Sustainable Finance Disclosure Regulation (SFDR) is a new transparency requirement for financial market participants related to key environmental, social and governance (ESG) criteria. The purpose is to increase market transparency and direct capital towards more sustainable businesses. SFDR imposes different disclosure obligations on Financial Market Participants, depending on their size and the nature of their products and/ or services. All participants in the EU will need to make general disclosures about sustainability practices for both the entity and their products and/ or services. They will also need to report on their Principle Adverse Impacts (PAIs), which are a series of indicators covering a range of ESG issues, such as greenhouse gas emissions and waste management. At the moment, most companies and funds do not provide disclosures or collect data that is granular enough to satisfy the requirement, once it goes fully in effect, or to provide investors with the level of transparency that is expected by this regulation. GRESB, hence, offers an assessment that provides Financial Market Participants with the framework they need for their Principal Adverse Impact Statement. The Assessment is comprised of around 60 ESG metrics that need to be reported on (GRESB 3, 2023). The SFDR Assessment consists of a number of aspects that a participant is required to report on, including:

- Entity and Reporting Characteristics

- Climate and other environment-related indicators

- Social and employee, respect for human rights, anti-corruption and anti-bribery matters

The SFDR Assessment is broken into 3 parts to reflect the different tables of PAIs as outlined by the EU documentation. The Assessment evaluates performance against three ESG Components – Management, Performance, and Development. The methodology is consistent across different regions, investment vehicles and property types and aligns with international reporting frameworks, such as TCFD, GRI or PRI. The GRESB Real Estate Assessment provides investors with actionable information and tools to monitor and manage the ESG risks and opportunities of their investments, and to prepare for increasingly rigorous ESG obligations. These 3 tables are detailed as follows:

Table 1: Mandatory climate and other environment-related indicators, Social and employee, respect for human rights, anti-corruption and anti-bribery matters.

Table 1 focuses on 14 environmental and social indicators applicable to investments in investee companies and 2 indicators applicable to investments in real estate assets that have to be disclosed by financial market participants, these are considered as part of the “mandatory indicators that have to be reported on”.

Table 1 consists of 16 indicators across 7 aspects:

- Greenhouse gas emissions

- Biodiversity

- Water

- Waste

- Social and employee matters

- Fossil fuels (Real Estate specific indicators)

- Energy efficiency (Real Estate specific indicators)

Table 2: Additional climate and other environment-related indicators. These are considered to be optional although participants are encouraged to report on at least one of those indicators in order to abide by regulatory requirements. Table 2 consists of 16 applicable to investment in investee companies and 5 indicators specific to real estate across 9 aspects:

- Emissions

- Energy performance

- Water, waste and material emissions

- Green securities

- Greenhouse gas emissions (Real Estate specific indicators)

- Energy consumption (Real Estate specific indicators)

- Waste (Real Estate specific indicators)

- Resource consumption (Real Estate specific indicators)

- Biodiversity (Real Estate specific indicators)

Table 3: Additional indicators for social and employee, respect for human rights, anti-corruption and anti-bribery matters. These are considered to be optional although participants are encouraged to report on at least one of those indicators in order to abide by regulatory requirements. Table 3 consists of 17 indicators across 3 aspects:

- Social and employee matters

- Human rights

- Anti-corruption and anti-bribery

Those issues in 3 Tables are reported through following tools (online) that help participants with the submission process:

- Assessment Access Tool: A participating property company or fund manager can invite colleagues, advisors and consultants to register in the Portal to assist with the submission of data to GRESB.

- Asset-level data tools: GRESB has developed a number of tools to assist participants with the collection and aggregation of asset-level data that is required to complete the SFDR Assessment.

- The Portal has real-time error detection systems and warnings (GRESB 4, 2023).

The tools are designed to streamline data flows and increase data quality. For example,

- Application Programming Interface (API): This tool is available through an increasing number of data providers. It allows participants to seamlessly feed information from a data provider’s data collection system to the GRESB Portal, automatically completing some of the indicators in tables 1 and 2 of the SFDR Real Estate Assessment. The full list of data partners can be found in GRESB Partner Directory (GRESB 5, 2023).

- GRESB Asset Spreadsheet: Participants who do not have access to the Automated Data Feed can upload asset data to the GRESB Asset Portal using the Asset Spreadsheet. Please check the SFDR Assessment Instructions tab of the Asset Spreadsheet for more information (GRESB 6, 2023).

*Note that the term table is used as a reference point to the mandatory and optional indicators as per the template provided by the EU but that the SFDR Assessment Portal itself is not composed of ‘’tables’’. The SFDR report will however be in table format.

The goal of the GRESB Assessments is to capture the most material ESG data related to the sustainability performance of real estate and infrastructure companies and assets. This data and the insights derived from it are used by investors to assess organizational exposure to various risks and to identify new opportunities to invest in strong-performing companies. For a detailed description of the new governance structure, the GRESB Standards Development Process, and the changes for the 2023 GRESB Standards, by relating more to external frameworks as showed in Table 1.

| Real Estate | Infrastructure |

| IR Framework | CDP |

| CDP | PRI |

| SASB | GRI |

| GRI | SASB |

| PRI |

For each external framework, GRESB created an analysis table with the framework’s relevant indicators, which were mapped to specific indicators from the relevant GRESB’s standards. From this, GRESB analyzed the level of alignment between the GRESB indicators and those from the external framework (GRESB 7, 2023). GRESB collects, validates, scores, and independently benchmarks ESG data to provide business intelligence, engagement tools, and regulatory reporting solutions for investors, and asset managers in the wider industry. GRESB provides a rigorous methodology and consistent framework to measure the ESG performance of individual assets and portfolios based on self-reported data. Performance assessments are guided by what investors and the wider industries consider to be material issues, and they are aligned with the Sustainable Development Goals, the Paris Climate Agreement and major international reporting frameworks. Through a GRESB Membership, data is reported to the relevant GRESB Assessment each year on a regular cycle and are validated by a third party and scored before being used to generate the following ESG benchmarks for the industry:

- Real Estate Benchmark

- Real Estate Development Benchmark

- Infrastructure Fund Benchmark

- Infrastructure Asset Benchmark

Each year, GRESB publishes the global aggregated benchmark data showing the state of ESG in the industry. The benchmark itself evolves over time, ensuring that scores reflect relative performance and evolving sustainability expectations (GRESB 8, 2023).

References:

AccountAbility (2018) AA1000 AccountAbility Principles. [online] New York: AccountAbility. Available from: https://www.accountability.org/standards/aa1000-accountability-principles/ [Accessed on 19 July 2023].

GRESB 1 (2023) GRESB Foundation. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://www.gresb.com/nl-en/gresb-foundation/ [Accessed on 17 July 2023].

GRESB 2 (2023) ESG Frameworks and Stakeholder Engagement. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://www.gresb.com/nl-en/esg-frameworks-and-stakeholder-engagement/ [Accessed on 17 July 2023].

GRESB 3 (2023) SFDR Reporting Solution. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://www.gresb.com/nl-en/products/sfdr-reporting/ [Accessed on 17 July 2023].

GRESB 4 (2023) GRESB Documents. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://documents.gresb.com/ [Accessed on 17 July 2023].

GRESB 5 (2023) Partner Directory. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://www.gresb.com/nl-en/gresb-partners/ [Accessed on 22 July 2023].

GRESB 6 (2023) GRESB Real Asset Spreadsheet. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://www.gresb.com/nl-en/?s=asset+spreadsheet [Accessed on 22 July 2023].

GRESB 7 (2023) How GRESB Aligns with Common ESG Reporting Frameworks. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from https://www.gresb.com/nl-en/how-gresb-aligns-with-common-esg-reporting-frameworks/ [Accessed on 17 July 2023].

GRESB 8 (2023) How We Work. [online] Amsterdam: Global Real Estate Sustainability Benchmark. Available from: https://www.gresb.com/nl-en/about-us/ [Accessed on 17 July 2023].