An Overview of ESG reporting

What is ESG reporting?

ESG reporting stands for Environment, Social, and Governance which are three components of sustainability that determine an organization’ success in the long-term. ESG reporting reveal measurable activities that how well organizations integrate environmental impact, social responsibility, and governance practices. ESG reporting includes strategies and operations to create tangible value which benefit the company and stakeholders. ESG reporting, therefore, is a key area of focus for business looking to improve their sustainability credentials (Emerick, D., No Clue). In present, management teams at listed and public-interest companies are increasingly being required (by stock markets and government bodies) to provide ESG disclosure with their quarterly and annual reporting. Moreover, it is a communication tool that play an important role in convincing skeptical stakeholders such as investors, creditors, employees, consumers, etc. by showing transparent organization’s actions, risks, and opportunities. In contrast, Ineffective or mislead ESG reports may be considered greenwashing (Peterdy, K., 2023), which occurs when the management team within organization makes false, unsubstantiated, or outright misleading statements or claims about the sustainability of a product or service without a verifiability principle, or even about business operations more broadly. However, some greenwashing is unintentional, due to a lack of knowledge or understanding on the part of management, but sometimes greenwashing is also carried out intentionally through marketing efforts (Peterdy, K., 2022).

Scoring an ESG

As for an ESG score is an objective measurement or evaluation of a given organization, fund, or security’s performance under ESG issues. ESG scoring could be either industry-specific or industry-agnostic. Industry-specific scoring system evaluates issues that regard as material to the industry at large like substances of material, context of materials, or acquiring process of material, while industry-agnostic corporate broadly accepted factors that are meaningful across industries like climate change, human rights, or Diversity, Equity and Inclusion (DEI) (Miller, N. 2022). Courtnell, J. (2022) from Green Business Bureau (GBB) described ESG reporting in two types as 1) ESG Framework and 2) ESG Standard. ESG Framework is a framework is broad in its scope, giving a set of principles to guide and shape understanding of certain ESG topic. ESG frameworks will guide the direction of ESG reporting, but will not provide a methodology for the collection of information, data, or the reporting itself. Framework are useful to use alongside ESG standard, or when a well-defined standard does not exist. On the other side, ESG Standards are more specific in their focus. They contain detailed criteria explaining what needs to be reported. In the context of ESG, this means standards dedicate how information and data are collected, and how a report needs to be produced such as what topics and areas to include. Standards make frameworks more actionable by ensuring comparable, consistent, and reliable disclosure that appear in a report.

Standards and frameworks for ESG Reporting

While, Byrne, D. (2023) from Corporate Governance Institute (CGI) stated ESG reporting frameworks are more about principles and focus on grater questions, such as how information is structured, what information is collected, etc. and ESG reporting standards are more technical. They give specific requirements, like precise metrics for reporting each topic. Standards and frameworks should be used together for ensuring reliability of the reports. In addition, Letta, A. T. (2022) from esg.tech supported that the frameworks provide an overview of the structure and topic to be addressed. Standards provide detailed structures, including specific metrics and detail criteria. Frameworks are sometimes put into practice in absence of well-defined standards and/or allow flexibility in setting direction for reporting without prescribing a specific methodology. In more detail, Courtnell, J. (2022) divided ESG Frameworks into 3 categories including 1) Voluntary Disclosure Framework, 2) Guidance Framework, and 3) Third-Party Aggregators. Under voluntary disclosure frameworks, an organization actively discloses its sustainability-related policies, practice, performance data, and information related to ESG criteria, which includes checklist 25 steps of GBB. Popular voluntary disclosure frameworks are 1) Carbon Disclosure Project (CDP) 2) Global Real Estate Industry Benchmark (GRESB) 3) Dow Jones Sustainability Indices (DJSI). In terms of the guidance frameworks, they provide recommended methodologies and guidance to help companies identify, manage, and report on their ESG performance. The most popular guidance frameworks are 1) Sustainability Accounting Standards Board (SASB) 2) Global Reporting Initiative (GRI) 3) Task Force on Climate-Related Financial Disclosure (TCFD) 4) Carbon Disclosure Standard Board (CDSB) 5) International Integrated Reporting Council (IIRC). Finally, Third-Party Aggregators refer to framework that assess an organization’s performance based on aggregated, and publicly available data. The Data is collected from company-sourced filings, publications, company websites, annual reports, and/or sustainability or CSR reports. The main third-party aggregators are 1) Bloomberg Terminal ESG Analysis 2) Institutional Shareholder Service (ISS E&S) Quality Score (ISS) 3) Morgan Stanley Capital International (MSCI) 4) Sustainalytic. On the other hand, there are only 2 ESG reporting standards showed, which are 1) European Financial Reporting Advisory Group (EFRAG) and 2) International Sustainability Standard Board (ISSB). When, Byrne, D. (2023) mentioned only 4 common ESG report frameworks, which falls under the guidance frameworks, comparing with data from Courtnell, J. (2022), including 1) Task Force on Climate-Related Financial Disclosure (TCFD) 2) International Integrated Reporting Council (IIRC) 3) Global Reporting Initiative (GRI) 4) Carbon Disclosure Standard Board (CDSB). And common ESG reporting standard are 1) European Financial Reporting Advisory Group (EFRAG) 2) International Sustainability Standard Board (ISSB) and 3) The sustainability Accounting Standard Board (SASB), which Courtnell J. identified it as a guidance framework. On the other hand, Letta, A. T. (2022) only stated 1) Task Force on Climate-Related Financial Disclosure (TCFD) as an example of ESG report frameworks and 2 global recognized ESG report standards including 1) Global Reporting Initiative (GRI), which both Courtnell, J. and Byrne, D. identified as a guidance framework, and 2) Sustainability Accounting Standards Board (SASB), which Courtnell, J. identified as a guidance framework, but D. argued it is a standard as well as Letta, A. T.

ESG in Thailand

In Thailand, we are at the starting point to surf on ESG flow. The Stock Exchange of Thailand (SET) revealed Sustainability Reporting Guide for listed companies together with ESG metrics for each industry group in 2022. The guide line for sustainability reporting also complied with the 56-1 One Report form and can be used as a vital checklist for sustainable business development and investment (SET, 2022). Apisak Kiewkarnka, deputy manager and head of finance for the SET, said the bourse had developed a SET-ESG framework focused on fulfilling 4 specific sustainable development goals: 1) industry innovation and infrastructure ()SDG-9, 2) responsible consumption and production (SDG-12), 3) reduce inequity (SDG-10), and 4) climate action (SDG-13) (Kiewkarnka, A., 2022), while Anantananon, R. (2022) assistant manager and head of sustainable business for the SET added there are 2 platforms are under development 1) SET ESG Data Platform to make ESG-related data disclosure mandatory for companies 2) SET ESG Academy to rise awareness regarding ESG among companies and universities. An intimate partner to stock exchange sector as the bank industry in Thailand also announced ESG declaration in 2022 in order to set the banking industry’s clear common direction in addressing ESG agenda. The Thai Bankers’ Association (TBA) outlined action priorities in addressing ESG risks and opportunities regard to climate change (SDG-13), diversity and human rights (SDG-5), financial inclusion (SDG-8), and reduced inequities (SDG-5), while fully supporting Thailand toward UN SDGs and commitment to the Paris Agreement. All TBA members agreed on 6 shared action priorities including 1) Governance 2) Strategy 3) ESG Risk Management 4) Financial Product 5) Communication 6) Disclosure (BOT & TBA, 2022). Assoc. Prof. Phd. Nattavud Pimpa Assistant Dean Sustainability, College of Management, Mahidol University stated that Thai businesses are still leaning to fully comprehend the need to integrate ESG factors into their operations. Great obstacles in adopting ESG are the lack of consensus and consistency in ESG reporting and measurements, lack of the manpower or technology to devote to the extension effort required to collect and analyze ESG data, and lack of transparency in formal systems (Pimpa, N., 2023).

Current ESG Situations

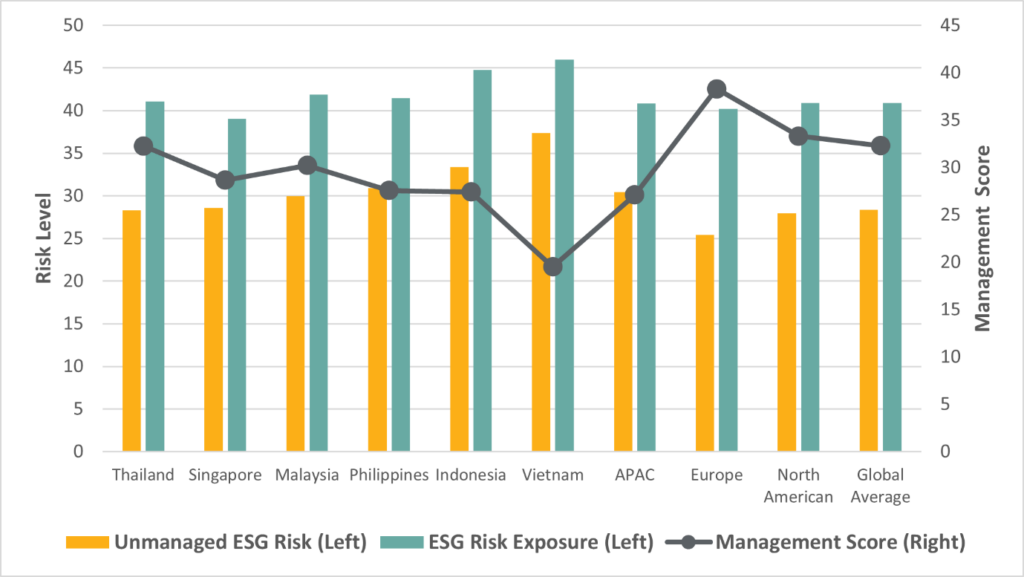

It is obviously seen that there are many commotions in the ESG overview at the moment either in global or local notion in terms of reporting framework and standard, which there is no absolute for any countries. At the end of the day, all of these tangible evidences expose significant trend and transition toward sustainability from capital sector around the world. Organizations both government and Private, therefore, should start to adjust their operating mindset and monitor about related ESG issues from different fields in order to create their own ESG strategies, action plans, and clear, consistent, and align reporting frameworks, which suite for each organization and get on with their stakeholders. Each organization from different backgrounds and industries may requires different necessary resource and expertise to manage, collect, and analyze reliable ESG data, in some organization will consume higher cost and time for accomplished goals though (Pimpa, N., 2023). However, Thailand is a leader in 6 Asean countries (Singapore, Malaysia, Thailand, Vietnam, Indonesia, and Philippines) in terms of average ESG performance. The sustainability disclosure performance ranking in 2019 by Corporate Knights, a research firm, the Stock Exchange of Thailand ranked 9th of 47 stock exchanges worldwide, which is the highest of all of the APAC region. Following by The Singapore Exchange, Philippine Stock Exchange and Indonesia Stock Exchange rake 24, 30, and 36, respectively. Vietnam and Indonesia show higher unmanaged ESG risk due to lower managed score and higher exposure to high ESG risk industries such as mining, oil and gas, steel, i.e. (Pan, F., 2021) and (Walker, R., 2021).

ASEAN ESG performance comparison 2019

Source from: Sustainalytics https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/esg-disclosure-and-performance-in-southeast-asia

References:

- Byrne, Dan (2023) What’s the difference between ESG reporting standards and frameworks. [online] London: Corporate Governance Institute (CGI). Available from: https://www.thecorporategovernanceinstitute.com/insights/guides/whats-the-difference-between-esg-reporting-standards-and-frameworks/ [Access 12 May 2023].

- Courtnell, Jane (2022) ESG Reporting Frameworks, Standards, and Requirements. [online] Texas: Green Business Bureau. Available from https://greenbusinessbureau.com/esg/esg-reporting-esg-frameworks/ [Access 9 May 2023].

- Emerick, Dean (No clue) What is ESG Reporting? [online] Ontario: ESG/ The Report. Available from: https://www.esgthereport.com/what-is-esg-reporting/ [Access 12 May 2023].

- Letta Anamim Tesfaye (2022) What is the difference between ESG framworks and standards? [online] Paris: esg.tech. Available from: https://esg.tech/how-to/esg-frameworks-and-standards/ [Access 12 May 2023].

- Miller, Noah (2022) ESG Score. [Online] Vancouver: Corporate Finance Institute (CFI). Available from https://corporatefinanceinstitute.com/resources/esg/esg-score/ [Access 12 May 2023].

- Pan, Frank (2021) ESG Disclosure and Performance in Southeast Asia. [online] London: Sustainalytics. Available from: https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/esg-disclosure-and-performance-in-southeast-asia [Access 13 May 2023].

- Peterdy, Kyle (2022) Greenwashing. [online] Vancouver: Corporate Finance Institute (CFI). Available from: https://corporatefinanceinstitute.com/resources/esg/greenwashing/ [Access 12 May 2023].

- Peterdy, Kyle (2023) ESG Disclosure. [online] Vancouver: Corporate Finance Institute (CFI). Available from https://corporatefinanceinstitute.com/resources/esg/esg-disclosure/ [Access: 12 May 2023].

- Walker, Rupert (2021) Thailand leads ESG disclosure in Southeast Asia. [online] London: MA Financial Media. Available from: https://fundselectorasia.com/thailand-leads-esg-disclosure-in-southeast-asia/ [Access 13 May 2023].

- Anantananon, Ratwalee (2022) Set launches platforms to promote ESG Practices. [online] Bangkok: Bangkok Post. Available from: https://www.bangkokpost.com/business/2303434/set-launches-platforms-to-promote-esg-practices [Access 13 May 2023].

- Bank of Thailand (BOT) and The Thai Bankers’ Association (TBA) (2022) Joint Press Release: TBA launches ESG Declaration, a strong collective commitment to expediting sustainable development toward better and greener economy. [online] Bank of Thailand (BOT). Available from: https://www.bot.or.th/landscape/en/news/2022/08/29/esg-declaration/ [Access 13 May 2023].

- Kiewkarnka, Apisak (2022) Set launches platforms to promote ESG Practices. [online] Bangkok: Bangkok Post. Available from: https://www.bangkokpost.com/business/2303434/set-launches-platforms-to-promote-esg-practices [Access 13 May 2023].

- Pimpa, Nattavud (2023) ESG: Poison or Panacea for Thai Business? [online] Bangkok: The Nation (Thailand). Available from: https://www.nationthailand.com/blogs/special-edition/esg/40026137 [Access 13 May 2023].

- SET (2022) ESG The Stock Exchange of Thailand (SET) introduces Sustainability Reporting Guide. [online] Bangkok: Thailand Business News. Available from: https://www.thailand-business-news.com/set/89984-the-stock-exchange-of-thailand-set-introduces-sustainability-reporting-guide [Access 13 May 2023].